My net salary is wrong. Why? What can I do?

This is quite a common occurrence, and this article is inspired by a story of unpaid salary Northern Ireland health service workers who in May 2014 were being paid less than they were due, or in some cases being paid twice! The unions NIPSA and Unison were understandably cheesed off with this issue – blamed on a new payroll system installed in October 2013. A 6 minute interview with a union official and me about this case is at http://youtu.be/Ri9SfcNVAE0

This article will tell you how to complain if you are paid the right amount, and how to take a case to an Industrial Tribunal or Employment Tribunal. Also the websites and phone numbers.

Why might your employer pay you too little or too much:

- Their computer system is playing up (as above)

- They are using the wrong tax code (or National Insurance code)

- They have decided to deduct something from your pay – maybe for accommodation, or something you damaged

- They worked out your pay wrongly

Let’s look at these scenarios in a little bit more depth, and consider your options.

Computer system playing up

These days it is very easy to blame computers for things going wrong, but of course it needs a human to be at the heart of the problem. That human might have designed the system poorly. Or they might work in payroll and have put the wrong information into the computer (and guess what comes out!)

One is much less sympathetic when the employer has hundreds or thousands of employees, because the assumption would be that they buy in a powerful payroll program or service which can cope with all eventualities. (More on this later.)

Using the wrong tax or National Insurance code

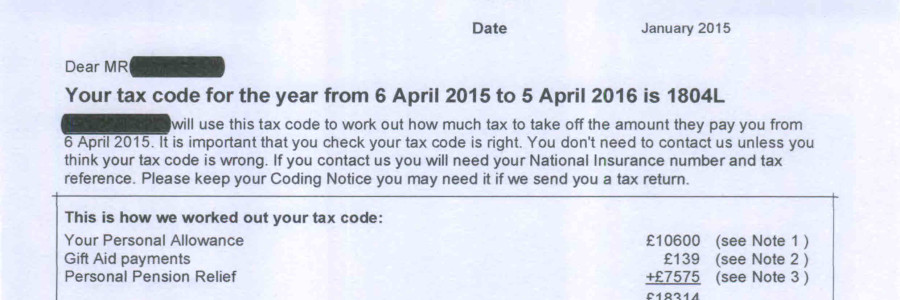

Lots of people are aware of tax codes, even if they don’t fully understand them. Fewer people are aware that there are different codes for National Insurance, and these too can make a big difference to your net pay. NI codes appear as letters, A, B etc. A is the standard one.

Your tax code tells your employer how much tax to take off you each pay-day. No amount of complaining to your wages department will get your tax code changed. They can only change the code on instruction from HMRC.

If you think your tax code is wrong then phone HMRC on 0300 200 3300. They are open 8 to 8 Monday to Friday and until 4 on a Saturday. Have your National Insurance number handy, and make sure to note down the name of the person you speak to, plus the date and time of the call.

If HMRC agrees that your employer is operating the wrong code they can issue one to work. It should then be used in the next payroll run. If not then talk to your wages department or to HMRC again.

Our son recently had an employer who operated the wrong tax code and even after HMRC issued correct ones, still failed to use them. It took a lot of pressure to get the thing sorted. Don’t give up!

National Insurance (NI) codes tell the wages department how much NI to take off your pay. A lot of people are on the same NI code and all will work smoothly. However if someone has more than one job, they can ask HMRC to issue a special NI code, and save themselves money.

On the National Insurance type of problems, my wife Felicity Huston worked part-time for the Northern Ireland civil service, as well as being a director of Huston & Co. She applied to HMRC and the correct, special NI code was issued to the civil service. They refused to operate it, potentially costing Felicity over a thousand pounds a year. Despite employing tens of thousands of staff, they claimed their payroll system was incapable of using this special NI code. Only by threatening taking a claim to an Industrial Tribunal (Employment Tribunal) did the civil service wake up and smell the coffee. Somehow they managed to do what HMRC was requiring of them.

Refusal of an employer to operate a tax or NI code is simply not an option. The law requires the employer to do as HMRC says.

If you are paid too much, then your employer is entitled to have their money back. If you have spent it before the problem came to light them your employer should be reasonable in how they ask you to repay it. They might, for example, seek your agreement to paying it back over a number of months.

Employer has deducted something from your pay

Sometimes your pay packet is light because your employer has deducted something else, apart from tax and National Insurance. This could be for:

- Replacement uniforms

- Damaged goods or equipment

- Accommodation

- Private phone calls on a company phone

- Private purchases on a company card

The key tests here are firstly is the deduction correct and fair? Secondly is the employer entitled simply to deduct this from your pay? Check your contract or staff handbook.

If you think the deduction is wrong, or shouldn’t have been taken out of your pay, then you should raise this matter in writing with your employer, in the first instance. In unsatisfied with their response there needs to be an appeal, and then you can take the matter of unpaid salary to an Industrial Tribunal (or Employment Tribunal.) The claim you are making is that the employer has made an “unlawful deduction from wages.”

Employer has worked out your pay incorrectly – you have unpaid salary

This could be because you feel you have unpaid salary or wages as they haven’t

- paid you for all your hours worked

- paid overtime at the right rate

- paid you less than an equivalent worker of a different sex

- given you the sick pay you were entitled to

In each of these cases you need to put your concern in a letter to the employer, and if need be then appeal their decision. After that you are back to taking a case to an Industrial or Employment Tribunal.

Contacts for Industrial Tribunals / Employment Tribunals

Northern Ireland – http://www.employmenttribunalsni.co.uk 028 9032 7666

England & Wales – http://www.justice.gov.uk/tribunals/employment 030 0123 1024

Scotland – http://www.justice.gov.uk/tribunals/employment 014 1354 8574

At all of the stages of taking a complaint you could use your trade union or solicitor to help make your case, but of course the solicitor will need paid, the union will offer free advice, as will Citizens Advice.

Adrian Huston is a former tax inspector, now director of Huston & Co Tax Consultants & Accountants. www.huston.co.uk 028 9080 6080 @HustonTax